Beneficiaries and your pension

Learn the options available to you when choosing a beneficiary (or beneficiaries) for your pension benefit.

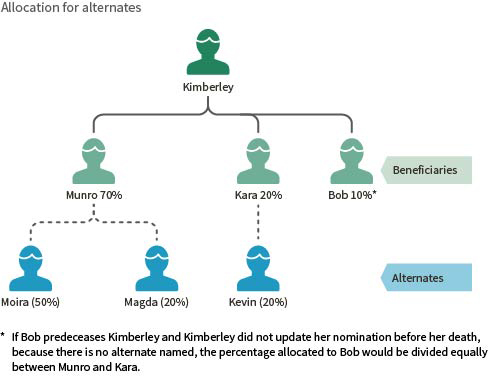

Naming alternate beneficiaries

You may want to name an alternate beneficiary(ies) should a beneficiary die before you.

For example, if your spouse dies before you and you have listed your two children as alternate beneficiaries, they will receive a pension benefit from the plan when you die.

You can name more than one alternate for each beneficiary. If you have more than one alternate beneficiary, the percentage of the pension plan benefit for all alternate beneficiaries named must add up to 100 per cent.

You can choose to give a different percentage to each alternate beneficiary, but the total percentage must add up to the amount you gave to the original beneficiary.

If an alternate beneficiary dies, you may want to name one or more new alternate beneficiaries.