Pension Life - Winter 2024

Your pension is secure

Message from the trustees

Over the past few years, it seems like the only constant has been change. The world has reacted to a global pandemic, increased inflation and a series of unprecedented severe weather events. While there continues to be change on a global scale, one thing will remain the same: you can rely on your pension.

Our priority is to provide lifetime pensions. In 2023, thousands of members decided to retire, joining the more than 123,000 members like you who are already collecting a pension. We’re proud we continue to deliver reliable pensions, especially as the world remains in flux.

This commitment is reflected in our disciplined investment strategy. Our focus on the future helps us to navigate challenges. Instead of reacting to short-term market downturns, we stay the course, knowing that our diversified portfolio is prepared to withstand fluctuations. Responsible investing has been a key part of this strategy and will remain important, especially as we continue along the path toward our net-zero goal.

We understand there will always be change. By remaining consistent in our approach, we will keep your pension healthy and secure now and for the future.

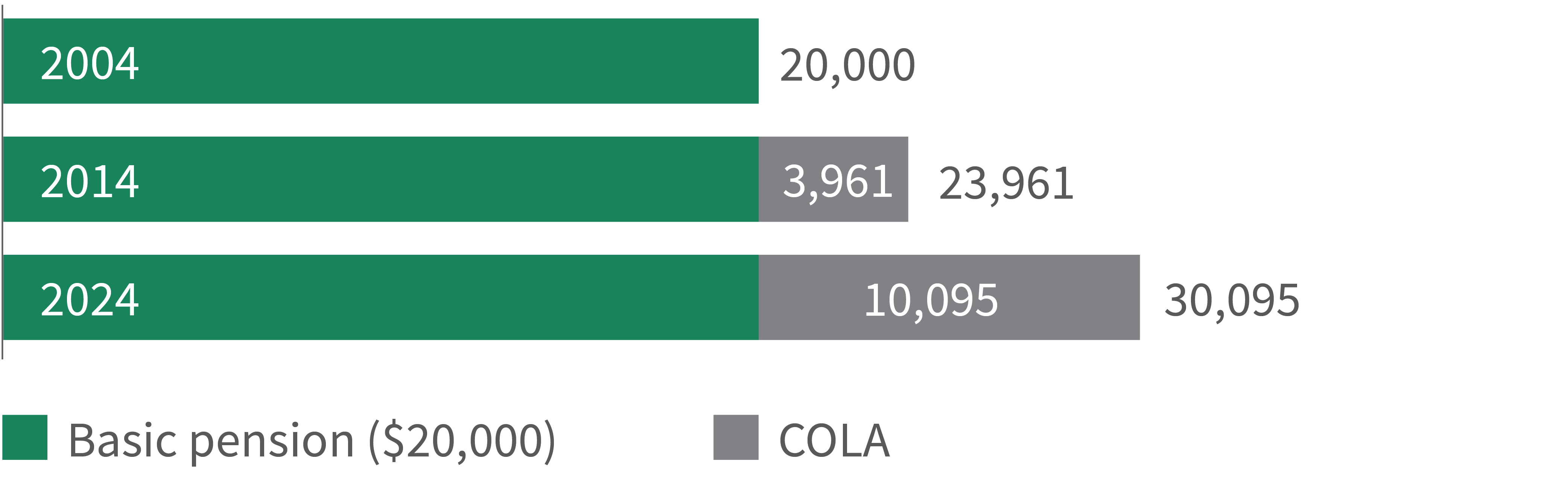

The graph below shows how an average pension granted 20 years ago has grown due to COLAs.

Basic pension plus COLA granted ($)

Your 2024 cost-of-living adjustment (COLA) is 3.8 per cent

The COLA is based on the change in the Canadian consumer price index from September 2022 to September 2023. COLAs help your pension keep pace with inflation and the rising cost of goods in the marketplace.

Your group benefits are managed by the Municipal Retiree Benefit Trust (MRBT).

The MRBT has been responsible for managing your group benefits since 2022. This trust framework offers stability for funding group benefits and makes the program more sustainable.

The board transferred $20 million to the trust in 2022. An additional $40 million was transferred in 2023. These funds come from employer contributions that would otherwise go to the inflation adjustment account and are in addition to regular employer contributions.