COLA: A recipe for improving your pension

Cost-of-living adjustments can help preserve your buying power throughout your retirement.

Just as you may receive a pay raise while working that helps offset increases in the cost of living, your future pension payments may increase from a cost-of-living adjustment, which we refer to by its acronym, COLA. These adjustments, when provided, help your pension keep pace with increases in the cost of living.

This isn’t a guaranteed benefit, so you may not receive COLA each year, and the amount may change from year to year. However, once you receive an adjustment, it will be added to each component of your pension for as long as you are to receive them. For the basic pension, it's for the life of the pension. Future COLAs will then be added to the new value of your basic pension.

Each year, BC's Municipal Pension Board of Trustees (board) carefully reviews several factors to decide whether to grant COLA and, if so, its value.

To understand how the COLA concept works, it helps to understand how your pension is funded.

Basic Account = Basic pension

Member and employer contributions and investment returns fund the basic account. You will receive your basic pension every month until you die. Depending on the pension option you choose, your named beneficiary may receive a pension benefit after your death.

The basic account is fully funded and your basic pension is secure and guaranteed for life. The board knows this because it hires an independent actuary to conduct a valuation every three years to see if this account is fully funded. If an actuarial valuation indicates there is a funding shortfall, the board must raise contribution rates for both members and employers to ensure the account remains fully funded.

Inflation Adjustment Account = The source of COLA

Separate from and unlike the basic account, the inflation adjustment account is not fully funded. However, like the basic account, member and employer contributions and investment returns also fund this account. While your basic pension is based on a formula, COLAs are non-guaranteed benefits, based on the funds available in the inflation adjustment account. If the board grants COLA in a particular year, funds from the inflation adjustment account are transferred to the basic account so that they can be applied to your basic pension, and bridge benefit and temporary annuity, if applicable.

Calculating the COLA

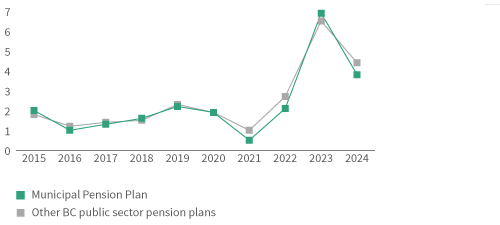

You may have noticed some pension plans have COLA amounts that are different from yours. That’s because BC public sector pension plans have different ways of calculating the COLA. In general, different calculation methods generate different annual COLA amounts. The good news is that no method produces results that are consistently higher or lower than the others over multiple years.

Calculation methods

The COLA is calculated using monthly rates from the Canadian consumer price index (CPI). Your plan uses the difference between September CPIs. With this method, the COLA is based on the percentage change between the current year’s September CPI and the previous September’s CPI.

Other BC public sector pension plans may use the annual percentage change in the average CPI. With this method, the COLA is based on the annual percentage change in the 12-month average CPI from one year to the next. Each year, that average, from November to October, is compared to the average for the 12-month period that came before it. The difference between the two 12-month periods becomes the COLA.

Example

In some years, one method generates a higher COLA; in some years, the other method generates a higher amount.

COLA methodologies comparison (%)

Because of COLA/inflation adjustment caps, some plans did not grant the full COLA/inflation adjustment amounts determined by their plan's methodology in certain years.

Sustainable COLA keeps it sweet

A cap on the amount of COLA provided has helped to maintain the long-term sustainability of funds in the inflation adjustment account so they are not used up faster than they can be replaced. That’s why the plan rules and funding policy specify that:

- The cost of providing COLA cannot exceed the funds in the inflation adjustment account

- The amount of COLA cannot be higher than the increase in the Canadian consumer price index (CPI)

- The maximum COLA amount that can be granted cannot be greater than the COLA cap

There will be no cap for 2023 through 2025. The valuation report showed that the plan can maintain full inflation adjustments over this period. The board anticipates being able to grant COLAs in line with the annual changes in the CPI. For example, the COLA granted January 1, may be the increase in CPI from the previous September to September.

Every three years, the plan’s independent actuary (a specialist in financial modelling, the laws of probability and risk management), will assess the cap for the next three years and recommend the board adjust it if needed.

Although there is no cap on COLA during this time, trustees still have the discretion to provide a COLA that is less than the increase in the CPI from September to September.

"A COLA helps your pension keep pace with increases in the cost of living."